Date Written: 3/29/2023

Assignment: Explain the basics of the Austrian theory of the business cycle.

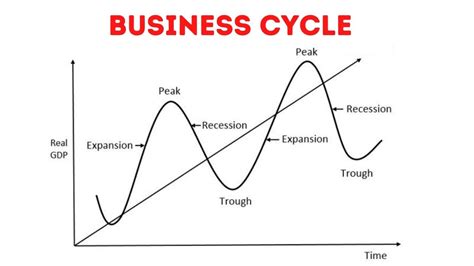

A common criticism of the free-market is that it is prone to business cycles. That is when there are periods of great economic growth followed by crashes where many businesses suffer losses. However, is this cycle actually a product of the free-market?

Why would this business cycle occur? The free-market selects for the best entrepreneurs; all the bad ones go out of business. That is the natural process of the free-market. So, why would all of these good entrepreneurs all make bad business decisions all at the same time, thus resulting in a recession/depression? The reason is that they were mislead by interest rates.

Interest rates play a critical role in the business cycle because they are the signals that tell businesses when to invest in long-term projects. When interest rates go down businesses are incentivized to start their long-term projects, like building a new factory or doing research and development. This is because they will need loans for their projects and they won’t have to pay nearly as much money back on those loans if they get them when interest rates are low. The converse of this is true as well. When interest rates are high business will not start their long-term projects.

The Normal Behavior of Interest Rates

Let’s consider how interest rates come about when they are not interfered with. It all starts with the public. When the public saves money they put it in a bank for safe-keeping. The banks then lend out this money to other people seeking loans. When people save more money the banks have more to lend. When banks have more to lend interest rates go down because the more of something there is the lower the price will be. So, when people save more money interest rates go down.

There is another less obvious effect of people saving more money. When people save more money they are obviously not buying goods in the present. They are saving to buy things in the future. When people aren’t buying things in the present, less capital goods need to be devoted to producing things in the present. Therefore, less wood, steel, labor, trucking, etc. will be needed to produce things that satisfy consumer’s desires now. These capital goods will be freed up to be used in the new projects of businesses.

The free-market does a great job at coordinating this entire process. When consumers save money interest rates go down. This tells businesses that less resources are needed to produce things in the present and that consumers are willing to wait to buy things in the future. So, businesses can start their long-term projects that are aimed at producing more and better things in the future that don’t bring an immediate profit. The resources will be available to do their projects as they are not needed to make things in the present. Without any government intervention the individual choices of people in a free-market make this incredible process function. But where does the business cycle come into play?

What Causes the Business Cycle

In reality, the government is who is to blame for the business cycle. As has been shown, interest rates are what signal businesses to start their long-term projects. Business cycles are caused by the artificial lowering of interest rates by governments/government-backed central banks. When interest rates are changed this way it sends false signals to businesses.

The amazing coordination that the free-market creates gets all messed up. This way interest rates aren’t lowered by people saving money, instead they are lowered artificially. If people aren’t saving money, then they aren’t buying less. If they aren’t buying less, no capital goods will be freed up for use on other projects. The consumers still want to buy goods in the present. However, businesses that have been mislead by false interest rates will start their long-term projects that are aimed at producing in the future. The resources required to build and operate these projects are still being used by the sector of the economy that is producing goods for the present.

This all leads to a crash as both sectors of the economy are trying to grow at once. Eventually businesses realize that consumers aren’t saving money to buy goods in the future. Therefore, the resources that they need to do their projects will still be being used by the sector of the economy producing goods for the present. So all the resources will either be unavailable or too expensive. Their projects will fail and they experience extreme losses. This happens to many good businesses at the same time because the were sent false signals by false interest rates. The recession/depressions are when the economy is sorting itself out after the misallocation of so many resources.

An Example

To better understand this, imagine someone was building a house. They needed 10,000 bricks to complete the house. They were told by their associate that they had enough bricks to complete the house, so they began construction. However, their associate was wrong and they only had 5,000 bricks. Eventually, once the builder is half-done building the house they realize that they don’t have enough bricks. They can’t buy more bricks as they are needed in many other places in the economy, so they are unavailable or very expensive. So they can’t afford to finish the house. All of their work and the materials they used were wasted.

In this scenario the person building the house is like the businesses and the associate is like the government. The builder was given false information by their associate, so they made the mistake of building a house they couldn’t finish. The same thing goes for the businesses. They are given false information by interest rates that are government influenced, so they start projects they can’t complete.

In conclusion, business cycles aren’t a figment of the free-market. They are caused by governments artificially lowering interest rates, which send false signals to businesses to start their long-term projects. Then these projects fail because the resources aren’t available and then comes the crash. If interest rates are left alone, the free-market will wonderfully coordinate the whole system and business cycles will no longer be a problem.

Good job. Your writing sure make me think.